Back on February 5th, 2013, we announced that the Foundation had started the process of shifting its Mission Focus to include Executive Function Theory. A number of you emailed us to wish us well. Thanks very much for those well wishes. A few of you wished us well and then effectively asked, “What’s EF and how does it apply to philanthropy?” In this blog post I’d like to take a stab at answering that question by offering up a case example from our grant history.

Back in fiscal year 1999–2000, we made a grant to Valencia County Habitat for Humanity here in New Mexico. Back when we were making grants mainly in the northeast (in the early to mid-1980s), we supported Habitat for Humanity. We were familiar with Habitat and what they were about: homing the homeless. Honestly though, Valencia Habitat’s grant request caught us off guard. Let me explain why.

The Executive Director of Valencia Habitat back then told us a “behind the scenes” story. He told us that Valencia Habitat operated just like most of the regional Habitat organizations: get building materials donated, buy inexpensive building lots, have volunteers build the house in record time (often in one weekend), have the prospective Habitat homeowner put in a lot of sweat equity, and then turn the house over to the new Habitat homeowner with a zero interest loan. That’s the story most of us think about when we think of Habitat for Humanity. But in Valencia County, the story takes a strange twist: new Habitat homeowners were losing their homes at an alarming rate. Here’s what was happening.

No sooner would a Habitat homeowner move into their new house when there would be a knock at the door. On the other side: an unscrupulous lender. Most of the new Habitat homeowners did not know that the moment they were handed the keys to the front door, they were stepping into instant home equity, in may instances on the level of $30,000. Apparently unscrupulous lenders used this ignorance (e.g., an “EF gap”—more on this below) to their advantage. Simply, these lenders would refinance the zero interest loan, allow the Habitat Homeowner to have $30,000 in equity in one lump sum, and then saddle the Habitat homeowner with a eight or nine percent interest loan. And the loan was for the full appraised market value of the home. (The Habitat loan was for a value below market because so much of the cost was donated.) As the Valencia Habitat Executive Director told us (and I paraphrase), “Many of the new Habitat homeowners had addiction histories, whether alcohol, drugs, gambling, or you name it, and they simply had no way of delaying gratification.” He continued (still paraphrasing), “They jumped at the chance to have $30,000 dollars in their hands all at one time and did not stop to assess future consequences.” The ED told us that, sadly, in most cases the money would be gone in months if not weeks. And when the Habitat homeowner could not make payments on the high interest loan, they would default. Foreclosure was soon to follow. The unscrupulous lender would then turn around and double his investment by selling the Habitat home at market value. As the ED told us (more paraphrasing), “I feel terrible but we are unintentionally setting these people up to be targeted and preyed upon by unscrupulous lenders. We thought we were giving these people a safe and secure home to live in away from predators when in fact we in essence painted a red bullseye on their backs.”

“So, what was the Foundation’s grant used for?” you may well ask. Here’s a description from the grant application:

We are requesting a grant to develop a homeowner education class for very low income families. Included in these classes will be resources to address areas of alcohol, drug, child and domestic violence abuse, financial education and child care. Very low income families are often victims of oppression because they are uneducated and fall prey to those wishing to take advantage of them financially.

Ultimately Valencia Habitat was able to use our grant to partner with other agencies (a local investment firm, a domestic violence shelter, a rape crisis center, etc.) to accomplish the following goals (as outlined in their final report):

Homeowners attended eight homeownership sessions using a manual that we prepared that covered the following topics:

- Home maintenance

- Home finance

- Domestic violence protection

- Sexual abuse protection

- Chemical dependency education

- First Aid – CPR

- Self directed education on issues identified as needs by the participants

The Homeownership Manual was duplicated and distributed to other Habitat affiliates (and the general public) at no cost.

So, what does all of this have to do with EF or Executive Function? Well, according to the information that Russell Barkley presents in his book Executive Functions—What They Are, How They Work, and Why They Evolved, understanding economic concepts, like mortgages, interest rates, equity, market values, home maintenance, home cost budgeting, etc., requires fairly sophisticated EF functioning and skills. Consider this passage by Barkley on page 21 of his book:

Humans daily engage in reciprocal exchange and must frequently and rapidly evaluate the costs-benefits to them of doing so as each party to the transactions goes about pursuing their actions toward their future goals, no matter whether the exchange involves money, goods, or services. This is the field of economics broadly defined. Yet where does this widespread human goal-directed activity ever enter into modern views of EF?

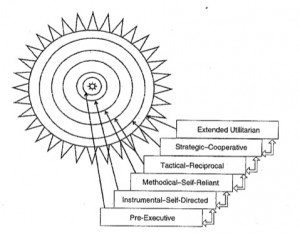

To put Barkley’s above observation concerning the connection between EF and economics into perspective, here are Barkley’s levels of EF in ascending order:

- Instrumental EF (i.e., setting your alarm clock)

- Methodical or Self-Reliant EF (i.e., daily routines—hygiene, food, safety, etc.)

- Tactical or Reciprocal EF (i.e., social reciprocal or symbiotic relationships)

- Strategic or Cooperative EF (i.e., longterm view of goals & consequences)

- Extended or Utilitarian EF (i.e., codes of ethics, standards of care, legal statutes)

Barkley’s EF Model—reprinted with permission of The Guildford Press and taken from the following work: Executive Functions by Russell Barkley (2012, p. 171). This model suggests that: 1) EF levels are hierarchically arranged in a dynamic system, and, 2) a bidirectional flow of information exists between the various levels. See Executive Functions for a complete description of this model.

The EF skills required to successfully negotiate the arena of complex economic concepts and transactions exist at the levels of Tactical or Reciprocal EF as well as Strategic or Cooperative EF. Ergo, for a person to be successful once placed in a home and subjected to such issues as a home mortgage, home budget, home maintenance, etc., that person should have achieved at least a Tactical or Reciprocal EF skill level. Ideally, they should be able to operate at the level of Strategic or Cooperative EF, which is where longterm planning, goals, and consequences enter the EF picture.

The Valencia Habitat project pointed out that in many cases new Habitat homeowners lacked the necessary EF skills to properly and effectively navigate the homeownership environment. The training program that our Foundation funded was designed to give Habitat homeowners the necessary EF skills so that they could be successful and prosperous homeowners. The project did not assume that the training program alone would magically develop EF skills; it instead made sure that Habitat homeowners had access to help with EF challenges—consultants, counselors, advocates, financial planners, lawyers, etc. Sometimes EF is simply about knowing where to turn to to get help with challenges to the EF system.

I’ll end this post by posing an ethical question: “Do philanthropists have an ethical and moral obligation to assess for such things as adaptive EF functioning levels before technically making a grant?” I would say yes. Keep in mind that the recent housing bubble was created in large part because of EF gaps—lenders engaging in lending practices that would require a very high level of EF functioning to figure out (I still don’t fully understand what happened), and borrowers that had low levels of EF functioning (who, if you will recall, were specifically targeted, just like the Valenica County Habitat homeowners). Should philanthropists assess for EF functioning levels and EF gaps? I guess a lot depends on the type of worldview one ascribes to. What’s your thought on the subject? Feel free to leave a comment. Should philanthropists engage in “EF handholding,” or should they be able to fund projects on a technical level only, and then let the EF chips fall where they may? I think these questions are timely because we are in the middle of yet another bubble—the student debt bubble. Americans now owe more on student loans (almost one trillion dollars) than on credit card debit. Are unscrupulous lenders yet again taking advantage of EF gaps?

Postscript—After reading his book I had the pleasure of exchanging a couple of emails with Dr. Barkley. We were discussing the possibility of a webinar on EF down the road (stay tuned for updates). Dr. Barkley told me that he views ADHD (attention deficit and hyperactivity disorder) as a disorder of the EF system, and structures his talks using this view. Ergo, we could frame the current ADHD epidemic as an EF system disorder epidemic. Projecting out, once this epidemic matures (e.g., children now young adults) we may see EF gaps on a level never seen before. Dr. Barkley also pointed out (as other researchers have as well) that although behavioral drugs like Ritalin and Adderall (both commonly used to treat ADHD) do control behavior (like impulsivity), they do not play a role in developing EF skills or functioning. Longterm, these types of behavioral drugs only make the problem worse, not better. Personally, I’m not sure we as a society are prepared for the tsunami that would be the impending EF system disorder epidemic once it enters early mature stages.